Just when the decision of America getting ‘Trump’ed’ bowling the world over with much speculations of ‘what will happen now?’ Prime Minister Modi decided to bowl a googly and get the nation back on their toes to take a stock of their hard earned money. But the ball the Modi government rolled out came as a real surprise to many, the nation began to get a grip of the situation through a shaky ground. Many strongly criticised the move, many wholeheartedly appreciated. Much was told and shared and chatted about at every corner of the nation. Tea cups witnessed heated debates, local train conversations were all galore about DEMONITISATION.

Silencing a democracy with a change is certainly not easy and when it is an opinionated country like India, the dissection takes place at several quarters and plateaus. But looking back at the last few days does not certainly help us contemplate on the outcome as a whole, rather everyone is still waiting to clear away from the confusion to embrace the change in full totality. But we better shift our attention towards the textile industry and look into the depths of the business model of the lingerie industry and how each corner of the same has been touched with a change. But our investigation was more to bring out the voice of the retailers, wholesalers, distributors etc to know how the industry is responding to the changes.

Turning Black into white!

Modi government clearly stated that the move marked a prosperous change and underlined a full fledged reason that many would not want contest, ‘Eradicating black money from the financial system‘. Claims of cleaning up the economy through demonetisation did prove a little sticky for the Manchester of Maharashtra- Ichalkaranji, as textile mills and cotton-weaving powerlooms were being offered banned currency notes towards payment.

In just 15 days, the daily turnover at the textile hub has plummeted from Rs 45 crore to Rs 13 crore as traders began cancelling orders owing to the fact that mills stopped accepting old currency notes. Bulk orders got cancelled and transportation of raw material got delayed too. More than 80,000 workers engaged in the looms and the yarning, sizing and processing units were leaving the town as payment of their wages got deferred. With the workers quitting work, the situation went out of hand for the powerloom sector.

Ichalkaranji Powerloom Weavers Cooperative Association Limited, noted this move by the government as a big bomb that would cripple the textile hubs in the longer run. Mahendra Buccha, a prominent lingerie distributor from Andhra Pradesh however commented, ” the initial build up and chaos owing to panic was way more severe rather than the actual effect of the scenario. The manufacturers or manufacturing hub who were always positive about their worker strength has stood beside their labours and they have patiently dealt with the situation too. Even though we had to face our own share of order cuts, owing to demonetisation. We are positive that this systematic move will only benefit us in the longer run and build a more connected platform.”

He also mentioned a capital worthy system that this move has created and will uphold in the time to come. Traders who dealt with hard cash sought rescue to mills who were accepting old notes, but on rejection they pulled back orders too. Contracts worth more than Rs 100 crore have been scrapped at several nook and corner in the country.

The money chaos

Manufacturers, manufacturer associations and mill associations had to refuse old currency interactions as more than anything else, they complained that depositing such large sum of money would bring them under vigilance. Even major names within the textile industry had to struggle with growing inventory . Owing to a shortage in demand for material stocks began to pile up. With stocks starting to pile up across the value chain of the textile industry and companies not in a position to collect any receivables resulting in a serious impact on cash flows, textile mills also urged the union government to provide a one-year suspension on repayment of loans and interest. M Senthil Kumar, chairman, Southern India Mills’ Association (SIMA) mentioned that, the withdrawal of around 86% of the currency in circulation and issuance of less than 10% of currency in the denomination of Rs 2,000 has led to severe shortage of funds for regular operations, purchase of raw material, sale of finished goods and also the purchase of the regular requirements of stores, spares, and accessories within the textile industry.

People began to hold on to the money they had thinking about emergencies and even retail showrooms and shops, all the MBOs across the nation were hit by the cash crunch and low sales. According to him, normalcy in every way will come back to the textile industry only after at least 6 months. He further added that since the performance of the textile units in the post-demonetisation period has aggravated, it is essential to increase the period for classifying existing NPAs (non-performing assets) from 90 days to one year to avoid textile units turning sick. The working capital limit should also be enhanced to 50%, he urged.

Another point that came out in the light owing to the sudden build up was that, a large number of the workers in textile mills do not have savings bank accounts due to cumbersome procedures including submission of KYC (know your customer) details. This is normally a condition that the migrant workers face and they are stopped from opening savings bank accounts owing to the long KYC procedures. SIMA urges the government to give necessary direction to banks to enable workers to open accounts instantly by showing any ID proof.

But Mr. Pankaj Jain, owner of Quality General Store, Delhi mentioned,” the buying pattern for customers will directly improve, owing to the conversion from cash to plastic money. Women will have a direct knowhow of how much money they have stocked in their account and that will thereby better their purchasing capacity and power in the longer run. Consumers will certainly feel more secure with this conversion and dependence on plastic money will also smoothen the edges with time.” He further added that from a lingerie retailer point of view he is feeling more confident with this change and is embracing the digital technology with open arms. He also mentioned that before this move was taken they were not so keen on accepting cards or any online payments. But now they are following the rising concerns to go digital and he feels when customers had cash in hand, they always looked for discounts. But now they are ok with the price they are offered as they don’t have to bother about change etc and can easily swipe their cards.

Following Mr. Jain’s lead Umesh Vashist, owner of Gopal Sons, Delhi explained, “impulsive buyers or people who normally window shop and then end up buying has completely stopped coming to the stores. And lingerie is not an everyday object that people will drop in to buy the same regularly. Owing to which business has certainly dropped by 40% since the time government declared this turning black to white move. But what has become more prominent in the longer run is that buying will get a systematic direction now onwards. 80% of buying from now will be turned towards e money and he certainly wants to stay positive with this move. As he believes the same will yield better results and sales figure in the time to come.”

But hoping that the economy will soon become a viable ground, is it too much to hope for? While tolerance level in people, specially the ones involved with cash dealing has been going steady until now, owing to the positivity that people are patiently embracing, but certainly the experts are visioning something ‘not so good’, as an outcome of this sudden move. Leading Noble laureate and economist Amartya Sen criticised the move and mentioned that only an authoritarian government can calmly cause such misery to the people, depriving millions of innocent people of their money subjecting them to suffering, inconvenience and indignity in trying to get their own money back.

Citing on the same consequence former Prime Minister, Dr. Manmohan Singh also heavily critiqued the move mentioning that the national income will fall by 2 percent in the time to come owing to this move. Which he has underlined as an organised loot and a ‘monumental mismanagement’.

Turning ‘Cashless’

E commerce has certainly brought in heavy discounts and a series of effective digital comforts for the people who were queuing up for hours to withdraw their hard earned money. While there was limits imposed on withdrawals, the e-commerce scenario became prosperous by the day opening up more options and allowing people the ‘power to purchase’. But haven’t we really lost the liquidity of the market?

An angry wholesaler from Mumbai, Noor Muhammad complained vehemently, in fact he was sarcastically expressed himself so as to highlight the extent of his suffering. Business has been fairly abrupt and equally chaotic in the days following the fiasco owing to demonization and the so called eradication process undertaken by the government to remove hoard of black money, (which was later termed as fake money) from the market. While the ongoing debate leads to one affirmation that slowly a segment called unorganised will either vanish or get covered up by the structure and working of the organised sector. But was this really required? A debacle to suddenly organise a developing economy of millions.

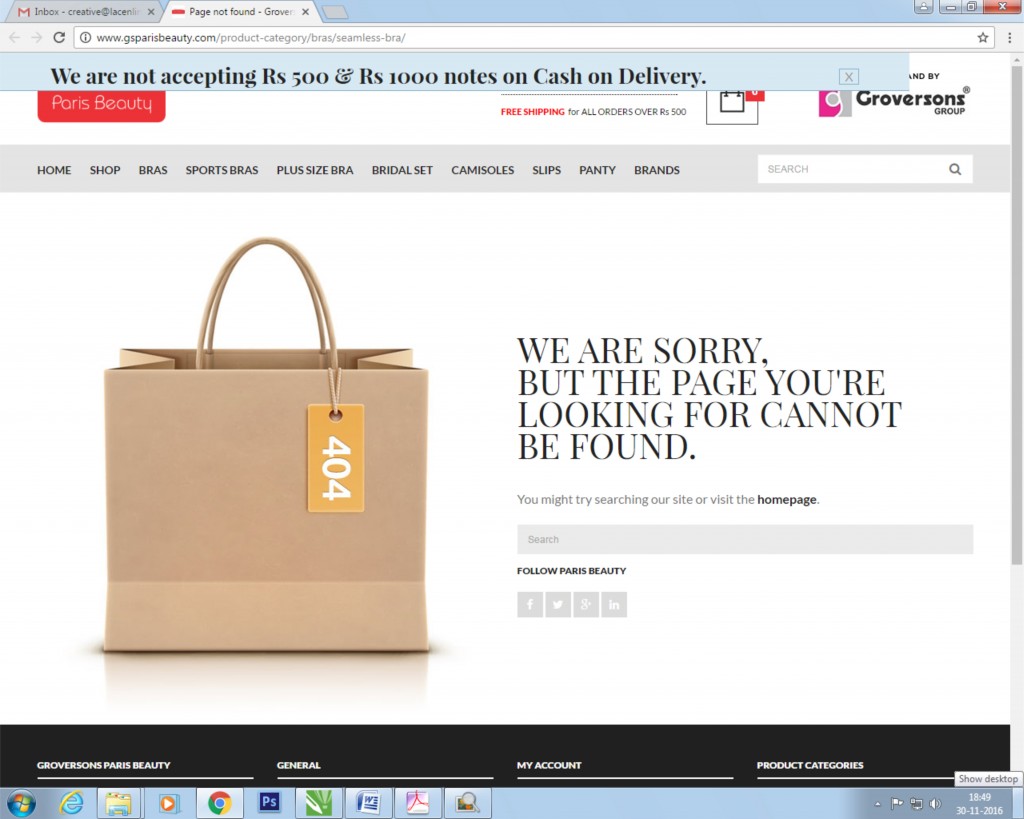

So let’s hear it from Groverson’s Group, one of India’s oldest and leading lingerie manufacturer and brand. Siddharth Grover, Director, Groversons, an expert it in the trade lists the pointers that the industry has had to face owing to the sudden demonetisation movement.

Impact on sales: there was an immediate impact of demonetisation on sales , but with every passing day sales are improving , if I talk about specific retail sales at our exclusive stores we have started doing regular sales the only change is that customers have sifted from paying by card.

Problems being faced by the industry, including retailers, distributors and manufacturers: To the industry the issues come from the retail level , the consumer buying pattern will define the channel , manufacturers do not have a immediate direct impact but is affected by the channel where buying was done on cash , till the consumer gets acquainted and accepts the new concept of cashless buying or the economy has cash in proper circulation everyone will have to adjust themselves to the situation. After all this is for the benefit for us as citizens of the country for a better future.

Inconvenience being faced by the customers: There was an inconvenience to the customers in the first week , but as I said earlier as well people are adapting and shifting to buying via card or other methods like mobile apps. This inconvenience in my view is very short term and less to what benefits we’ll get in the future.

Decrease in sales when compared to last year: We’ve had a good year till now , but this definitely will have some impact on the sales on the whole , we are moving one step and a time observing the situation every day , I am positive that this won’t dent the sales too much , but just caused a small bump , everything should get better by January is what we are hoping for.

Gloom for the loom

The majority of workforce in the textile industry are migrants from Uttar Pradesh, Bihar, Orissa, Andhra Pradesh, Maharashtra, Rajasthan, etc. Thousands of workers are being laid off as powerloom firms find it hard to function amid the cash crunch. The blow has also reached a high for the textile industry of Surat, which has a turnover of thousands of crores, but has been suddenly paralysed after the Centre demonetised Rs 500 and Rs 1,000 notes. Thousands of workers were being laid off as powerloom firms find it hard to function amid the cash crunch. It was the dearth of liquid cash that suddenly hit the industry like a big storm and took away jobs of several. Even though many would contradict that the manufacturers who were prepared for the worse has timely stood by their labours. But the scenario at the ground level was not so welcoming.

The demand to manufacture new was also put to check as then the question of who will put in money to buy the same was also arising. With demands receding, the production had to be brought to a halt and thus the laying off of the working majority. Workers were returned back by their labour contractor with the excuse that machines in the factory were held up and only a few machines were working. The factory owners also complained that they faced problems in giving salaries as there was no demand from textile traders. It is estimated that the layoffs in textile units could be up to 40 percent of the total working population.

But on the other hand, several hosiery and undergarments manufacturer took this change to their stride and began accepting old 500 and 1000 currency notes from traders, to make their products purchase worthy at a time when otherwise the market was going downhill. This worked wonders for many of the popular and more influential manufacturers based all over India. They began to sell out their held up stock and clearing out their warehouses, so as to begin fresh production. And all this at the aftermath of DEMONITISATION. They happily claimed how they have added value to their latent production in just about a few days time, as they began accepting the held up currency notes and freed traders off their burden of having to exchange those notes.

The textile goods transporters in the city however was not a happy zone. They carry hundreds and thousands of parcels in the trucks and deliver them to other states. The textile goods transport sector was also badly affected as majority of trucks stopped plying. And they are the ones who efficiently run on cash, but unfortunately their smooth fluid functioning has also been checked through this money movement.

Sri Vinod Kumar Gupta, MD, Dollar Industries, another leading manufacturer and brand name of the intimate apparel industry is also entirely hopeful about the move. He commented, “Demonetization has been very good for the economy. This will surely be beneficial for the economy in the long run. It shall bring in a boon in balance sheet of India Inc. Yes, there are collateral damages but the government is taking steps to control. Government will also need to take measures to increase the demand back to the market. Of course, demonetization has impacted terrorist and illegal activities, besides counterfeit notes will be completely gone out of sight. “

Money that is nobody’s and was created unjustifiably will be washed away with time, the excess when it comes to justified money will be returned back to the economy and business will be blessed. Are all these versions of hope that only applies to the ideal state of the economy only when the move called demonetisation will be sought after as a blessing. But those are the ideal considerations and will only arise if we survive the state of emergency that we are in right now. The worth of this move will receive a fair conclusion and a pat of kudos only when the traders at every corner of the economy begin to face demand from the market and the market will only get back on its toes firmly when the consumers fill up the gap with money. Let’s hold on to our judgments and stay a little more tolerant for the days to come to arrive at the closure within a few months.