Growing fashion consciousness amongst people irrespective of the season has led to the demand of thermal wear in India. The brands are reaping rich dividends from this trend. Lace N Lingerie speaks with top brands to find out about the changing dynamics in the thermal wear industry and what’s in store this season.

The Indian thermal wear industry has evolved manifold in the last five years. Gone are the days when consumers used to clad two-three apparels to keep them warm. With the changing market and trends, consumers are becoming more brand-savvy and style-conscious…even while choosing their thermal wear. Sharing his thoughts on the changing market, Siddharth Grover, Director, Groversons Group, says, “Today, consumers are becoming more style conscious when it comes to thermal wear. They need good quality fashionable product even if it is offered by a domestic brand. The industry has become more innovative in terms of unique designs and features to be introduced in the products.”

Echoing similar views, Vinod Kumar Gupta, MD, Dollar Industries, says, “The thermal wear industry is changing at a great pace in India. People are now more fashion conscious. They are concerned about what they wear and how they look. They want their thermal wear to be cost-effective, more stylish and fashionable.”

The industry is further progressing by focusing on specifications such as heat retention, feel, style and design, and offering new and huge product choices to catch the fancy of more Indian consumers.

A booming category

The thermal wear category is growing fast and is paying rich dividends to retailers and brands. The demand for thermal wear can be gauged from the production by the brands. For instance, Lux Industries manufactures around 75 lakh thermal wear pieces annually. The thermal wear range contributed 15 per cent last year to the overall sales of the company. “Our thermal wears are growing 20 per cent year-on-year (YoY). We foresee a lot of potential in the market segment this year as well,” says a spokesperson from Lux, which is one of the leading players in the thermal wear market in India.

At Dollar Industries, the overall production capacity of thermal wear in FY18-19 was 30 lakh units. “Our thermal wear collection contributes to approximate 4 per cent of our overall sales. Over the years, we have seen 1 to 2 per cent consistent growth YoY,” says Vinod adding, “We have planned to increase the production by 10 per cent this year.”

Groversons’ overall production capacity is 4-5 lakh per annum. “Currently, the category contributes about 7 per cent in the overall sales.” He cautions that the contribution is increasing year over year but at a slower rate because of the unpredictable winter season and the weather having a major influence on the total sales.

Talking about the changing season, Niti Jain, Executive Director, Neva Garments, says, “From the past 3-4 years, there is a drastic change in the season, that’s why there is a shift in sales; the earlier thermal season meant after Diwali till Lohri. But nowadays, it has shifted from December to February.”

Neva Garments produces 15-18 lakh pieces per annum and the category contributes 55-60 per cent of the total sales, which is increasing YoY.

What’s trending?

Today’s new-age consumers are not much inclined to the age-old heavy winter wear; instead they are favouring and opting for light knitwear, which could provide maximum warmth and comfort without disrupting their outer appearance. Brands are also investing in newer technologies to be at par with the market trends. “There is a growing demand for more stylish, colourful thermals. Light weight thermals are preferred over traditional thick thermals. Lighter products are expected to be warmer too,” shares Vinod.

Indian consumers want their apparel to reflect their personality but are concerned about the cost, believes Vinod. Thus, value for money products are always in trend.

Besides, there is a tremendous change in colour preferences of the Indian consumers. Earlier white and grey were the only colors in demand, but with the changing trend cycle, brands have introduced a wide range of colours including mélange colour line. “In terms of neck designs, men prefer V-neck and women prefer deep round necks,” says Siddharth.

Styles like reglan sleeves and crew neck, tracksuits, trousers are expected to witness demand in menswear category while camisoles, sports bra, leggings, mini slip are in demand in women category.

What’s selling more?

There are categories, which are selling more than others. Dollar Industries has two product categories in thermal—value for money and premium.

In value for money category, in which it has brands like Wintercare and Esteem, the top selling categories are zero per cent shrinkage, round neck and V-neck.

While in the premium category, which has Ultra Thermals, men’s premium round, V-neck and women’s premium round neck are the highest selling products in this genre. “The average ticket size including both categories is INR 2,000,” adds Vinod.

Niti says that India is a mass market, that’s why consumption is also of low price segment. “As far as Neva is concerned, our highest selling category is ‘ESSANCIA’ followed by Mod Quilt,” she adds.

Sharing his experience, Mithun Gupta, Director, Bodycare International, says, “Bodycare Insider is our most exhaustive range of thermals for both men and women, which are made from quilt knit technology.”

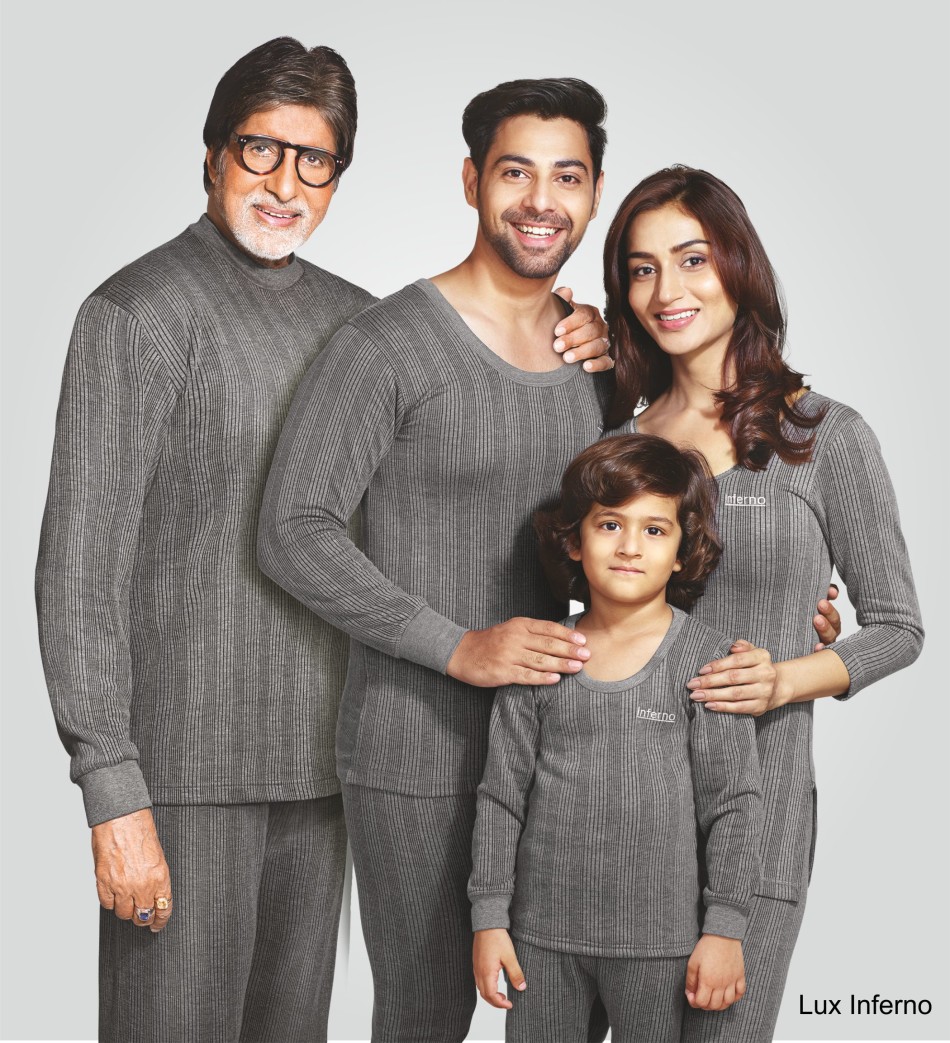

At Lux Industries, Lux Inferno is among the highest selling categories. Talking about the quality, the spokesperson says, “It retains body heat with brushed fabric inside and ensures warmth without weight. It is available in both round and V-shaped neckline and offers a variety of style and colour options for both the genders.”

Shares Siddharth, “Amongst all other categories of our winter wear brand Winta, premium thermals, which is our high-quality thermal wear range delivers warmth with matchless style and is the most preferred product of the winter season,” adding, “The average ticket size is INR 450.”

Region-wise variations

Thermal wear in India spans mostly across the northern states. “A matter of fact is, thermals are sold in places with chilly temperature. About 55 per cent of Lux Inferno is sold in the Northern states followed by 30 per cent sales in the East and 15 per cent in the West,” says the spokesperson from Lux.

Even Dollar Industries is witnessing maximum sales from the North. “Last financial year, sales figure in the North was INR 35cr, where demand is in large volume because of the geography. This is followed by East, where the figures stand at INR 25cr. The West and South together stand at INR 10.7cr, as these regions have summer and normal weather most of the year,” Vinod shares.

Groversons has also experienced good response of thermal wear from North region, which in total comprises of 70 per cent of the category sales, 20 per cent in the East and a total of 10 per cent in the West and South,” adds Siddharth. The company has 30 per cent production and sales strength in the kids’ category, 40 per cent in men and 30 per cent in women.

For Lux, menswear contributes 50 per cent of the category, women’s wear 35 per cent and kidswear 15 per cent. For Dollar, menswear contributes 50 per cent, women’s wear 35 per cent and kidswear 15 per cent. The category performs almost same for Lux. “Around 55 per cent for menswear, 30 per cent for women’s wear and 15 per cent of kidswear Lux Inferno are sold in the market every year,” says its spokesperson.

“This is but obvious, thermal sells in the winter belt only in the North and North East, which generates 70-75 per cent of our sales and the balance in the South and West,” says Niti. The break-up men, women and kids is 50-52 per cent, 22-24 per cent and 24-26 per cent, respectively.

What’s in-store?

Thermal is a seasonal product and retailers who would want to set them apart from the competition will surely keep their shelves illuminated with new additions. Let’s see what’s in store for the customers?

For the coming season, Dollar Industries is introducing variations in colour, change in measurements, upgraded quality of fabrics and new packaging too. “Before every season, we do research on issues faced by our customers. Thus, we have changed our overall measurements for better fittings. We have introduced new colour variations to make our thermals more attractive and stylish with innovative cuts and designs. We have upgraded the quality of fabric for better warmth and less sweat,” highlights Vinod. The company has also introduced brand new packaging, which makes the product more attractive for the customers.

Lux also comes up with new items every season, which are unique and different in themselves and have no comparison with other existing products. “We are coming up with round closed neck t-shirt for men to provide maximum comfort this winter,” says the spokesperson for Lux.

Meanwhile, Bodycare has launched its premium thermal range ‘Ayaki’ with unique Japanese technology. “The new ‘Ayaki’ range imbibes world-class Japanese Technology and promises to be the thinnest, lightest and warmest thermals available to the Indian consumers. ‘Ayaki’ further boasts of finest thermals especially crafted for sensitive skin and delivers the experience of soft intimate touch one aspires for,” claims Mithun.

This year, Groversons plans to provide customers with enhanced insulation using polyfill wedged between two layers of cotton. With soft brushed inner surface and quality sewing, the thermals absorb moisture from the skin, giving an aesthetic appeal and making it irritation-free. “Also, we plan to add a category of thermal blouse range for women, because there are regions where this particular range is in demand,” says Siddharth.

“As per our past market experience, we have inferred that there is a need to introduce a special category for the semi-winter season. And there is also a need to introduce more colours in the kids and men’s category,” says Siddharth.

Seeing the trend of previous years Neva has improvised the fabric quality, enhanced the stretch in rib. “We have also introduced velvety in S, M, L, XL this year as per market demand,” Niti says.

Adds Niti, “The premium consumer wants thermals in thin fabric, which is fit to body. So we introduced Sofit. Whereas customers from the hills want thick fabric. For them, we introduced Glaccia Thermal.”

“India is a mass market, so this time we had planned to enroll the lower middle-class customers with our brand by introducing Quiltex in the wholesale channel,” she adds.

Innovations in place

Thermal wear has been subjected to rigorous innovations and new features. Highlighting the same, Vinod says, “We have been consistently evolving our products following the latest trends in the fashion industry. Our range of thermals is upgraded and equipped with the best quality for every winter season. Recently, we have introduced sweat-resistant technology in our fabrics,” says Vinod.

“Our products are made up of upgraded material, a combination of wool and other fabrics, which make our thermal wear line sweat-resistant. This new fabric also gives more warmth than other brands in its category,” he adds.

Talking about the technology used in Lux Inferno, the spokesperson says, “Lux Inferno is finely crafted to keep its consumers warm and specially knitted to be worn as under the shirt and pants. A smart technology about the material used in Lux Inferno is that it has natural anti-bacterial qualities that make it odour-resistant.” Lux Inferno is designed in such a way that it can protect its consumers from extreme arctic conditions. It is made up from 100 per cent cotton and it is processed to give a silky smoothness on the wearer’s body. “We have worked on the material and made it softer and light, which makes it easy to wear under shirts or trousers,” he adds.

Meanwhile, Groversons is experimenting with features like material of the fabric, different weaving techniques and colour and design options to offer the best to the customers. “We aim to provide triple layer protection from the cold in winter for which Polyfill is sandwiched between two layers to create ‘cotton polyfill cotton’ thermal fabric, made on Hi-Tech German machines to provide enhanced insulation,” Siddharth says. The fabrics are treated with Amino Silicon softness, which makes the thermal light weight totally as per the demand of the urban population. This gives perfect softness to the fabric. Sewing of Winta thermal is done with Japanese Lock Stitch and Chain Stitch technology for aesthetic appeal and zero irritation. “Also we have introduced Lycra rib in neckline, cuffs and ankles for soft and comfortable grip,” states Siddharth.

Asked if the Indian consumer is willing to pay for value-added products, Mithun says, “Times have changed as local brands are competent in creating high-quality products and services and are more commonly affordable and available. Therefore, the Indian consumer is willing to pay for value-added products done by domestic brands.”

INTERNATIONAL FLAVOUR

The young demographics’ propensity towards the foreign tag has led to a fresh flurry of foreign brands to open up in India and expand in the thermal wear category too. For instance, Marks & Spencer thermal wear range, which sells thermal wear from vests to tights and leggings, is quite popular among Indian customers. Meanwhile, Jockey India also sells men’s thermals—long john, short and long sleeves vests, between the range of INR 500 and INR 900. They are available in white, off white, black and grey colours. In women wear, it has thermal spaghetti top, camisole, three-quarter sleeves top, leggings in off-white, charcoal, black, and skin colours. The price range is over INR 300 to over INR 700. In kids’ category, it has long sleeves vest thermals, long john for over INR 300.

What’s next?

Talking about the expansion plan, Vinod says, “We have our presence in all major cities and towns, yet if we look at the consumer market, we could reach only 30 per cent of the country’s geography. In the coming years, we plan to reach our end consumers at the last mile, taking Dollar to every Indian home.”

Lux Industries is looking to have a category extension. “We are constantly striving to introduce new technology and ideas to develop new products every year. We are in the pipeline for introducing much more superior quality thermal wear as compared to our current manufacturing,” says the company official. “Apart from looking into increasing our sales, we wish to foray into less penetrated areas to make our product more visible. We are also keeping abreast of international trends in order to boost the scope of Indian thermal market,” he says.

Groversons is planning to expand to international markets too. Says Siddharth, “Since it’s a seasonal product we are planning to expand it in the foreign markets for exports. With our expansion model, we look forward to expanding in the export market through increasing the production capacity of the product.”

What do customers say?

Let’s see what customers have to say about this growing category. Vikas Bansal, a research consultant from Delhi, says, “Given the frequency of social and cultural events in the winter season, thermal wear has become the preferred choice of customers. Indian consumers are always eager to be at par with global fashion trends and this has triggered the growth of the category.”

Echoing similar views, Neetu Arora, an IT professional from Mumbai says, “No doubt sweaters, cardigans and overcoats sell like hot cakes during the winter season but irresistible outerwear is forcing people to buy thermal wear more when compared to these trendy winter wears.”

What sellers say?

The retailers, distributors and wholesalers across India are witnessing a great response from thermal wear and making their bid to satisfy the new-age customer who is looking for innovations and variation in thermal wear as well. Preeti Sahni, Owner, Secrets, a retail store based out of Delhi, says that the customer needs innovation and freshness even in thermal wear. “They look for colours matching with their dresses,” she says. Instead of white and grey, she sold tan, burgundy and blue colours more last season. “Even black was well accepted by all age groups. Besides, smart casual and crop length tops were in demand. We sold plus size thermals—XL, XXL, more than other sizes,” she shares.

The brands that she stocked last year were Neva and Lovable, among others. Sahni even imports innovative thermals with fur and lining from China, Bangkok and other countries, which are well accepted by Indian customers, she says. She even got a few queries from Punjab wholesalers who were interested in keeping these designs at their shops and asked her to sell them.

Talking about the challenges, she says, “The weather in Delhi has been changing over the years, so we have witnessed a fall in demand of thermal wear.”

Paramount Enterprises is another distributor, which sells to multi-brand outlets like Chunmun, Snowhite and small retailers. Mukesh Doshi, Owner, Paramount Enterprises, says, “Light weight and value for money products are high in demand.” He also imports thermal wear from different countries. The company sells about 1.2 lakh SKUs per annum. “From September-October, we start getting the orders for kids wear and in November to January, we witness demand for adults’ category as well,” he mentions.

Yet another distributor based out of Chandigarh is Jindal Marketing who sells to retailers, MBOs, general stores and garment stores in Chandigarh, Panchkula and Himachal Pradesh. Talking about the demand, Jitin Jain, Owner, Jindal Marketing, says, “Cotton-based thermals are high in demand and customers are ready to pay price for the right product.”

The distributor stocks only the Bodycare brand and started stocking thermal wear from June. The demand for kids thermals starts from mid-September and for adults in October. November and December are the peak months, he says. “The category is growing 20-30 per cent year-on-year,” Jain adds. He shares yet another trend and says in areas like South Delhi, Chandigarh and in other posh areas, white colour is in demand.

Anita Arora, Owner, Peanuts, store in Noida, which sells thermal wear, says, “The customers look for value for money deals in this category.” The store stocks brands such as Jockey and Neva to name a few. “We stock the merchandise in the month of November and maximum sales take place in December and January,” she says. The owner is further looking to expand the category this year due to rising demand.

Clearly, thermal wear as a category is here to stay and grow for a long time.