How men’s innerwear brands are making a mark in the industry?

According to conservative estimates the men’s innerwear market, which is estimated to be worth Rs 11,000 crore in the year 2018, is expected to grow at a CAGR of 7 percent to reach

Rs 21,800 crore by 2028. Let’s see what brands, distributors, customers and retailers have to say about the growing industry and their plans further.

Among the core apparel categories, innerwear has emerged as one of the fastest growing categories in the last few decades. With rising aspirations, higher income and discretionary spending, and growing fashion consciousness among consumers, the innerwear segment is expected to continue to progress.

“Men’s innerwear segment has witnessed a drastic growth in the last few years. As innerwear today are no longer viewed as a commodity, customers are more looking at factors like comfort and eco-friendliness of the innerwear and are more conscious about the brand. According to a report by PWC, a sizeable chunk of the respondents to a survey were willing to shell out an additional amount on sustainable fashion and this includes innerwear. The men’s segment currently holds 35 per cent of the total market. The men’s innerwear segment is valued at around Rs.8,500 crore,” says Saket Todi, Senior Vice President, LUX ONN.

The innerwear market has traditionally been largely unorganised, although in the past few years, the organised innerwear segment has shown promising growth. This shows a clear roadmap for the players in the industry. Suresh Nambiar, Chief Executive Officer, Pepe Jeans, says, “It’s been great considering we did own set of research pertaining to category including the active players, current trends and whole cycle of research and development before arriving with this category. We are hardly a year and half old in this category and so far the response has been exceptional.”

“We are an apparel brand and this category is an extension of existing product ranges. For us innerwear is an add- on category under the apparel brand. Having said that, we saw a huge gap in mid premium segment in this category and we wish carve our niche in this space. As far as distribution is concerned, we do not plan to have any exclusive distribution, we will continue to retail through Pepe store,” he adds.

“India’s population is increasing day by day, more and more youths are joining the workforce. They are becoming self-dependent and are open to buy new products that are fashionable and aspiring. We are continuously increasing our product variety, thereby pushing the sales from different quarters,” says Vinod Kumar Gupta, Managing Director, Dollar Industries.

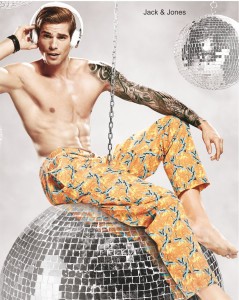

Mr Vineet Gautam, CEO and Country Head, BESTSELLER India (Jack & Jones) says, “Men’s innerwear, once considered only as a necessity has now become a fashion statement.

What was once the bastion of staid white has been breached by the emergence and acceptance of bright colours, funky prints and innovative designs.”

What’s in-store?

Dollar Industries has introduced the Bigboss Athleisure and Force NXT Athleisure, a brand new premium active wear collection for men and kids. “It is a line of comfort wear that keep you active all day long or help you relax when you are chilling,” says Gupta. The Athleisure collection is made by cotton-rich fabric which makes it more flexible, durable and washable than natural fabrics. The Bigboss Athleisure consists of variety of products such as Tees, Bermuda, Capri, Track Pant and Joggers. The Force NXT Athleisure range includes T-shirt, Tank Top, Jogger, Track Pant, Bermuda, Boxer and Pyjamas. Both the collection comes in a wide range of colours and style.

Talking about the market sentiments, Gupta says, “The market condition is bad, things are going down. There is an economic slowdown but the government is taking steps to boost up the economy. The Q1 has been bad but we are hopeful that the liquidity flow in the market will improve in the coming quarters.” He adds, “This year we aimed at achieving a growth of 15 per cent but due to the economic condition we got a growth of 11.5 per cent.”

Similar sentiments have been espoused by other brands managers as well who wish to remain incognito, saying they haven’t witnessed such a slowdown in the last few years, even more so during the demonetization. But they were also hopeful that the consumer sentiments will improve in the next two quarters once the festival season kicks in from mid August onwards and then there is a full season till end of the year.

Consumer Segments

As per Amit Gugani of Technopak, innerwear consumers can be segregated into four core groups on the basis of their attitude towards innerwear products and their buying behaviour.

The first group comprises men residing in metros and mini metros employed in high-paying jobs, earning high disposable incomes, having high aspirations, seeking only branded innerwear.

The next group also consists of consumers with well-paying jobs, but these consumers assess value along with various parameters of which price is just one; others are convenience of purchase, easy availability, style, quality, etc. Again, these consumers do not have any issue with paying a premium for innerwear products of a particular brand as long as the quality is assured.

The third group includes consumers from mostly Tier I, II and III cities having high aspirations and eager to have a metro-like lifestyle. They are open to experimenting through purchasing aspirational brands.

The last group of consumers consists of men who have low disposable incomes but have big dreams and aspirations. They have cautious buying patterns and value price over brands. For them comfort, price and quality are most crucial while purchasing innerwear.

According to a recent study, most of the consumers prefer buying innerwear only twice a year while about 10 per cent just buy them once a year and prefer to buy multiple products in one go.

The category is usually purchased on the replenishment of existing stock; that too customers prefer to buy it in packs of two or three. However, with fashion kicking in and influencing buying behavior, impulse buying has led consumers to buy it in singles as well.

Brands and product portfolio

There are a number of global and Indian brands, which dominate the men’s innerwear industry. The seven brands including Jockey, Amul Macho, Rupa, Lux, Dollar, Dixcy Scott, and VIP grab nearly 42 per cent of the market share.

Premium brands present in the market include UCB, Levi’s, Park Avenue, Jack & Jones, Us Polo, M&S, FCUK, FOTL, CK, Emporio Armani, Jockey International etc. The premium has a market share of 12 per cent and is growing at a good pace of 22 per cent YOY.

In a bid to retain its core customers and to diversify portfolio, Indian brands like Dollar, Lux, Rupa and Amul have introduced premium categories like Euro, Macroman and Zoiro, ONN.

That apart many existing companies have taken the licensing route to reach to the premium customers, with Rupa panning FOTL & FCUK, Lux having a manufacturing tie-up with One8, Dixcy Scott have panned out Levis, Dollar has entered into a tie-up with Pepe, Playboy has a tie-up with SR Mills

The Indian market is not saturated at the top end with brands like Van Heusen, US Polo have made serious dent in the premium segments and are considered serious players in this category. Besides there are new launches that is keeping the market egged on, KPR Mills a south based conglomerate has launched FASO in the South and will progress gradually pan India, another start up is XYXX a premium offering from a Surat based entrepreneur Yogesh Kabra.

These brands are introducing various types of innerwear. For instance, briefs come in low-ascent, medium ascent, skyscraper and numerous cuts. Innerwear apparel players are extending their product portfolios by venturing into activewear, casual wear, formal wear, etc. Brands have created sub categories of men’s innerwear like vests, briefs, boxers, shorts, pajamas, etc. “The innerwear industry continuously strives to bring in new styles and varieties for all segments. Recent examples like Glo Brief, Flexi Brief and Trunk, Modern Brief and Trunk, etc., are in point,” says Gupta.

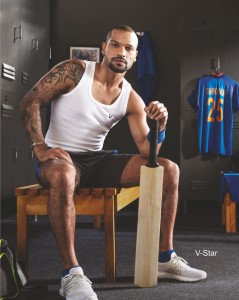

“The surprising number of different styles of innerwear is too many to count. For example, now briefs come in low-rise, medium-rise, high-rise, multiple cuts etc. Men’s innerwear styles now also feature a never-ending list,” avers Mrs Sheela Kochouseph MD V-Star Creations.

As far as styles and designs are concerned, Mr Harminder Sahni of Wazir Advisors says that the men’s Innerwear category is primarily driven by vests and briefs while the other sub-categories such as Sleepwear, Shorts etc. have a low share and are still in the nascent stages. “Active wear, one of the fastest growing categories, is estimated to grow at a CAGR of 18 per cent to reach INR 13,700 crore by FY 2024 from INR 6,000 crore in FY 2019,” he adds.

Just like the women’s innerwear segment, the men’s segment also divides the product range into classes such as super-premium, premium, medium and economy segments. Unlike the women’s segment, however, the economy segment in men’s innerwear is the highest contributor to total men’s innerwear segment. It is expected that in the next five years, the premium and super premium categories are going to witness a phenomenal growth due to growing brand awareness and fashion consciousness.

According to Sanjay Dawar MD Bodycare Creations, their brand has grown in the past one year by 25 per cent YOY. Hence, they’ve even launched a new range in Mens wear. “We have launched completely new collection of BodyX undergarments and have added new categories which includes boxers and shorts. The design language has also changed from Basic solid color designs to More vibrant ones to make it more appealing to the younger generation.

Unlike the women’s segment, however, within men’s innerwear, the economy segment is the highest contributor at 53 percent. The mid-price segment contributes 32 per cent, and the premium at 12 per cent and super premium segments constitute 03 per cent. It is expected that the premium and mid-price segments will grow fastest, and exponentially, in the next few years.

Online Vs. Physical Stores

Distribution channels play a very critical role in the success of a product. It is becoming very important, in today’s digital age, for products to be available where consumers are looking for them. This is why, innerwear brands are making a shift to online and are available on platforms like Myntra, Flipkart, Amazon, Jabong, etc. Some brands have their own websites as well, in addition to being available on online retail stores.

Besides, the Indian and global brands are present in the physical market across all metro cities as well as Tier II and III cities. The premium brands either have their exclusive brand outlets (EBOs) in prominent areas or malls or they are sold in departmental stores with multi-brand retailing. Since most global and regional brands have a similar distribution model, there is no shortage of supply. When it comes to style, customers have a variety of brands and styles to make a choice from. But in terms of sustainability, very few brands have a range to boast of. This is where some brands outsell others.

The presence of the brands across channels, both online and offline, simply shows how rigorous these brands are increasingly becoming about their visibility, awareness and popularity. Catering to the evolving Indian customer is making innerwear brands innovate.

“Innovation is the game changer. I take immense pride in saying that as a company, Dixcy has been at the forefront of innovation in the innerwear category. We were the first company in India to introduce innovative lines like gym vests, hooded sweatshirts and Spandex elastics. Around a decade back, we thought of athleisure, ahead of other competitors in India,” says Raghul Sikka, Executive Director, Dixcy Textiles.

“As the brand, our strategy is to grow across both channels. However, the online channel is growing at a very rapid pace, there is a phenomenal growth in this space. Right sizing is a very minuscule issue these days, people are already aware about their correct sizing. However, our 80 per cent traction still generates from offline channel, but online is a huge opportunity which is largely untapped,” Nambiar says.

Marketing & promotion

The men’s innerwear category is highly advertised and celebrities with universal influence and fan following from Bollywood are roped in as influencers. The men’s innerwear segment is the only segment to have a plethora of A-list celebrities like Shah Rukh Khan, Salman Khan, Ranveer Singh, Akshay Kumar, Hritik Roshan, and to cricketers now. This could perhaps be because the segment in addition to advertising, is trying to create awareness about the product range and performance.

“This industry has always been dependent on celebrities. In the future too, we will see celebrities endorsing different product varieties in different segments,” Gupta adds.

Sanjay Dawar attributes the growth in their brand to more appealing designs and the brand’s association with ‘Hardik Pandya’ has really helped uplift brand sales and visibility in the market today. On that front, on the association with celebrities he feels that it totally depends on where you want to take your brand and at what speed. “Yes, with celebrities you get the desired push and visibility to create a strong base to achieve success in a shorter span of time,” he tells us While aspects such as technology, disposable incomes, aspirational buying, etc., may contribute greatly to the growth of this segment, adding a celebrity to the mix too can augment a brand’s sales. Hence, celebrity endorsement is also one factor, due to which people buy a certain product. Like, V-Star, which has cricketer Shikhar Dhawan endorsing the brand. “Last year we have introduced some new patterns and styles, for which we got a very good response in the market. This year we have associated with the Indian cricket player Shikhar Dhavan, which helped us to make good movement in the market,” says Mrs Kochouseph.

She also believes that celebrity endorsement can help create brand awareness in a way that establishes the brand as a cut above its competitors. With their latest campaign, they joined hands with Shikhar Dhawan as part of their strategy to maximise their presence in the men’s innerwear segment. “Looking at the preliminary results, I can honestly say that our approach has really paid off. The growth rate that we have achieved in these past few months has been through the ceiling. So yeah, to answer your question, I believe that celebrities can go a long way in not just maintaining, but increasing the brand salience as well,” she tells us.

Television advertisements are the most popular platform and the biggest promotional influence for this category. In addition to TV ads, print media with full page ads are also popular, with brands foraying into in-shop branding, retail gate branding, product posters and event sponsorship. However, despite huge spend and heavy promotional activities, customer engagement in the innerwear segment is not very high. Brands are trying to bridge this gap by customized marketing. They are also trying to engage with young consumers and try and standardise conversation about innerwear and intimate wear.

However, Mr Kabra has a completely different take on this. He thinks that the celebrity endorsement space feels cluttered and saturated honestly. “Unlike the glory days of celebrity associations, today there is no longetivity or loyalty left in celebrity associations. While it has its merits in terms of visibility, given that any celebrity is doing 10 different brands and then adding the fact that every other brand has a celebrity attached to it, the distinction and recall that a brand would enjoy as a result of celebrity associations is lost. We believe it is better to use celebrities or influencers for relevant marketing activities like new launches or campaigns but do it sparingly and strategically for maximum impact,” he finishes.

Combining brand engagement and customer buying behaviour, brands are trying to take a more customised marketing approach. Innovative marketing is the way forward in this segment.

Challenges & Bottlenecks in India

There is a stiff competition in the market. Many apparel brands and retailers have extended their product portfolios to men’s innerwear segment as well to leverage its growth. Apparel players predominantly focusing on activewear, casualwear and even formalwear have launched dedicated sub-brands in men’s innerwear.

Jack & Jones too is looking at adding to their current portfolio and are planning to amplify gym wear as a category this year. “We are also looking at increasing our width in the current categories by adding more styles, fabrics, fits, and better technology,” finishes Mr Gautam.

According to Mr Sahni, the innerwear segment is still largely dominated by the unorganised sector. However, he feels that as many new players are entering the market, both domestic and international, a gradual shift is being observed and the organised sector is on a growth trajectory. “The market place too has seen a gradual shift from traditional hosiery shops to more organised retail channels such as LFS, EBOs, MBOs, and e-commerce,” he opines.

He too agrees with the others and feels that the growth opportunity for the men’s innerwear market is immense as brands are widening their reach and extending their product ranges. Also, while elevating the fashion quotient, various international and domestic innerwear brands in India are also expanding their collection beyond just innerwear. The range includes, Active Wear, Comfort Wear, Sleepwear, Loungewear, etc.

Besides, technology too is a big reason for the growth in the innerwear category. Mr Sahni states that advancement in this fabric as well as technology has contributed to the growth of this segment. “The brands are now focusing on innovative product lines that not only fulfil functional but also the fashion requirements of the new age customer. The category is constantly expanding in terms of variety, with advent of new shades, glow shine waist bands, stretchable wear, quick dry fabrics, etc.,” he says.

According to him, athleisure (tracks, gym vests/sportswear) is growing at 18 per cent CAGR between FY 2019-24.

While Mr Kabra hopes to see a 15 per cent growth in the mass premium segment. “The early signs show some concern on the growth of the industry but as a brand we are focusing on innovative product offering to help us meet the growth targets,” he explains

“There are a lot of outerwear companies entering into the innerwear segment. This is resulting into a more tough market. Low-level consumers are most cost conscious but when it comes to the mid level consumers they go for the brands while keeping the cost in their mind. Nowadays people are becoming more and more brand conscious,” says Gupta.

“For us, our competitors are the biggest challenge. To overcome them, we try to reach more markets where the competition is less,” says Gupta.

What distributors say?

Even the distributors are not satisfied with the growth of the category. Manoj Kumar Sarawagi, a distributor cum wholesaler from Ranchi, is witnessing about 15-20 per cent downfall in the men’s category. He blames it on unhealthy competition in the market. “There are many companies in the market, which have increased competition for us.” He even says that companies are providing schemes to push their stocks in the market but we are not able to sell it and the stocks are still pending due to slow off-take. Hence, there is no point in stocking the fresh material.

Yet, another retailer cum wholesaler from Jalandhar, Arihant Jain says, “We are witnessing an increase in premium category only.” People are moving to the premium category in the range between INR 500 and INR 600. He is pretty satisfied with the companies like Jockey saying, “Jockey is offering great schemes to dealers even before the season gets starts.”

While talking about another company UCB, he says, “UCB doesn’t have stock. They just sell their stock and their executives never come to see what’s happening in the market.” Even FCUK rates are a bit on the higher side, he feels.

He further says that companies have to keep innovating to win in the market. “Even if changing the colour combination, modifying elastic or any other small change are helping to attract customers, hence they should keep innovating,” he adds.

Nitish Jain, a distributor from Haryana, also feels a pinch in the market. “The growth is not up to the mark,” he feels. “The consumers are looking for value for money options. Quality is almost same for all the brands but it’s the pricing which makes a difference.”

Prashant Aggarwal, another distributor from Chandigarh says, “The market segment at this point of time is not at its best.” Talking about the challenges, he says, “Online retail is a big challenge for us. The conversation rate online is 60-70 per cent and offline its 80-90 per cent. But the walk-ins have reduced due to online retail. Hence, we are feeling the brunt.”

Innerwear is evolving from being functional to a segment with a fashion quotient. Talking about what’s in demand, Aggarwal says printed and soft elastic underwears are more in demand.

However, the distributors feel that there has been no rise in the sales in this segment. Bhisham Devjani, Shri Garments, Ajmer, who stocks brands such as Jockey, Barry & Clark, Van Heusen, Zoiro, UCB, says, “There’s no overall growth in the market in the past year.” He also says that changes in patterns, styles, fabrics keeps getting added every year.

Another distributor Binod Singh from Jamshedpur who keeps Amul, Dollar and Rupa not only agrees that there’s slow growth in men’s innerwear but says that growth is in negative numbers. As for styles and designs, he says that there some new ones such outer elastic, broad elastic, boxer pants.

Mr Jitender of JB Enterprise, Mumbai, stocks Rupa, Macho, TT, VIP, and states that there has been one or 2 per cent less growth than last year, equal to no overall growth. “New styles and designs come every year such as the perfume vest,” he adds.

Countering other distributors’ point of view, Pratap Singh from Sankalan, Jamshedpur who works with brands such as Amul, Rupa, Lux, Parrot, says that there’s 20 per cent overall growth in men’s innerwear and new patterns and styles keep getting added each year.

As for the forecast for next year, Mr Sanjay Dawar feels that as a manufacturer we hope that the coming festive season will bring a dramatic change and an uplift in sales numbers. “We are ready with our marketing plan and will go all guns blazing.” He adds emphatically.

What customers say?

“Shrinking disposable income is the prime reason Indian consumers are holding back from new purchases even in essential categories and staples,” says Rahul Khurana, Director Research, IMRB International.

“We look for value for money deals when it comes to essentials. Hence, online is the right platform for us,” believes Pankaj Kumar, an IT professional.

What’s next?

Innerwear once considered only as a basic necessity for personal hygiene, is slowly becoming a proper fashion statement. What was known for the bastion of white has seen the emergence, and acceptance, of bright shades, funky prints, and kinky designs. In the days to come people would no longer purchase innerwear as an after-thought. There would be specific products for sporting activities, for lounging, for the office, date night and so on. Underwear too would become like apparel, which will witness new launched every season and the current shelf life of a particular product style would come down considerably.

Men will look for comfort, functionality, and style, while ensuring it matches their outfit and the occasion. The growing aspirations and increasing disposable incomes will not only lead to higher consumption of premium brands and products but will also ensure increasing the market share of the organised sector.

Currently, the designs for underwear are universal in nature but one has to remember that what works for Americans and Europeans won’t work for Indians and Asians. Underwear needs to be tailor made according to the local body type and weather conditions. When one wouldn’t wear the same clothes for winter and summer, why should underwear be any different?

Along with this, brands will go across the channels on the booming high street, e-commerce and omni-channel distribution models. While brick-and-mortar stores will never become dead, online platforms will contribute a large extent to the growing demand, as it is far more convenient to shop online and at times cheaper.

We have aggressive plans to expand via offline channel as the part of strategy we are collaborating with leading departmental stores. Innerwear contributes around 13-14 per cent in the overall revenue of the brand. We aim to increase the number. Also, After a huge success of the initial launch in the Southern India, the brand is now expanding into North India and we are positive to receive the same amount of appreciation that we got from the initial launch. The brand has always worked on strategic progression by tapping new markets across each region having immense growth potential,” says Nambiar.

Talking about the plans further, Gupta says, “We are one of the few organisations in hosiery to have end to end manufacturing units. We keep on increasing our strength from time to time by including international mechanism and state of the art units.”

Overall, there are varying views about the growth in men’s innerwear. While some brands and distributors feel there will be a splurge in sales in the coming year, others state that the market will be down the following year. However, with changing consumer behaviour and brands’ marketing strategies, we can only wait and watch.

The growth of men’s innerwear market in India can be attributed to the following:

• Increasing penetration of organised players and emergence of online channel.

• Innerwear has moved from being a utilitarian product to a fashionable product. Indian men are upgrading their innerwear wardrobes and are now experimenting with styles, fabrics and brands and are buying more products than ever before. Further, increased consumer awareness regarding health, hygiene and fitness is also driving the market growth.

• Driven by the desire to look good, men these days are indulging in aspirational buying and are intending to buy better brands and products.

• The rising purchasing power among customers and the increasing number of dual income households are other factors that have boosted the market.

Courtesy: Wazir Associates

Editor’s note: While we have roped in the market experts as well as the brand owners and the distributors in this feature to uncover the men’s innerwear market, the next feature will revolve around consumers behavior, brand salience and retail speak.